Defined benefit plan contribution calculator

Thank you so much. If you are transferring out of a defined benefit scheme into a defined contribution scheme for example you should consider the fact that you are giving up a promised payment at retirement.

Financial Monthly Budget Template Monthly Budget Template Budget Template Budgeting

Workplace pension schemes set up by your employer or.

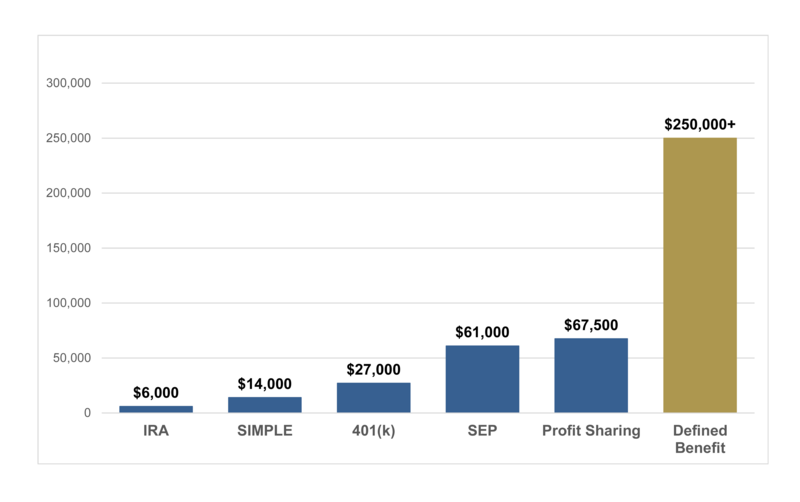

. Human Resource Development Plan. However a defined benefit plan could potentially have the highest contribution and tax deductibility for your business. Just target a desired level of retirement income and contribution amounts are adjusted each year to help you reach your goal.

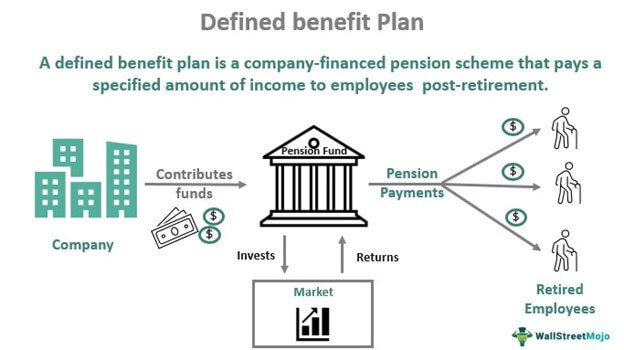

A Cash Balance Plan is a type of Defined Benefit Plan. The value of a defined contribution pension pot can fall as well as rise and you could get back less than the amount invested. A defined benefit plan is a retirement plan in which employers provide guaranteed retirement benefits to employees based on a set formula.

New Member Plan Comparison Calculator. A defined contribution plan is an employer-sponsored retirement plan funded by money from employers and employees. In less than 2 minutes youll have a custom proposal and can see how much you could save on taxes and add to your retirement savings.

Our Defined Benefit plan calculator gives a free estimate of your tax savings and overall plan accumulation. The calculator is for illustrative purposes and is an estimate. Who is a Member of the PERS Defined Benefit Plan.

A Defined Benefit Plan is a type of retirement plan. You can currently access your defined contribution pension on or after your 55th birthday whereas most defined benefit pensions usually have a retirement age of between 60 and 65 depending on the scheme. Defined Benefit Plan Calculator.

The PERS and TRS DCR plan is a hybrid plan. Defined contribution pensions can be. Learn More Account Access ORP for Political Appointees.

You are eligible for a lifetime monthly benefit from the defined benefit portion at age 60 with at least five years of qualifying service credit. In 2022 you can contribute 20500 to a 401k. Along with our writing editing and proofreading skills we ensure you get real value for your.

The money you save for retirement in a defined contribution plan is invested in. Your Civil Service pension. After your salary your pension is one of your biggest benefits.

Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions of the account. By now you probably understand the basic differences between defined benefit plans and defined contribution plans. 529 State Tax Calculator Learning Quest 529 Plan.

Benefit From Assignment Essays Extras. Both types of plans are governed by Internal Revenue Code IRC section 415. How Defined Benefits Are Funded and Distributed.

Private pension schemes set up by you. What are the 401k contribution limits in 2022. The 401k plan is the most ubiquitous DC plan among employers of all sizes while the similarly structured 403b plan is offered to employees of public schools and certain tax-exempt.

Transferring defined contribution schemes is much easier you can just take the funds with you. The Defined Benefit Plan contribution calculator does not quantify the cost of employee benefits. If you are a new SERS member you have 45 days to choose one of three retirement plan options.

A defined benefit plan more commonly known as a pension plan offers guaranteed retirement benefits for employees. Members who first entered on or after July 1 2006 are members of the Defined Contribution Retirement DCR Plan. Anything your company contributes is on top of that limit.

These plans often referred to as pension plans have become less and less common over the last few decadesThis decline is especially pronounced in the private sector where more and more employers have shifted to. Defined contribution plans establish the limit up front while defined benefit plans define a benefit at retirement. A fully insured defined benefit plan may allow a larger contribution than a traditional defined benefit plan.

Defined Benefits typically are paid for by the employer and Defined Benefit rules require employers to. If youre a member of a pension scheme through your workplace then your employer usually deducts your pension contributions from your salary before it is taxed. However depending on the ages and income levels of your employees the cost of benefits relative to tax savings may make good financial sense.

You probably know for example that a 401k is a type of defined contribution plan and you are probably aware that it receives special tax treatment from the IRS. For the contribution to be deductible the qualified organization must approve the program as furthering its own exempt purposes and must keep control over the use of the contributed funds. For a middle-aged individual in the top income tax bracket the contributions to the plan are generally in the range of 200000 each year so it might just be worth your minute to explore more.

The contribution is also deductible if the foreign charity is only an administrative arm of the qualified organization. Defined Benefit Plan information includes the service credit you earned. Individuals who first entered PERS before July 1 2006 are members of this plan.

Those who are 50 years or older can invest 6500 more or 27000. A Personal Defined Benefit Plan may be best for professionals age 50 or over who can make annual contributions of 90000 or more for at least five years. As an example a traditional Plan could provide a monthly pension starting at age 65 of 10000 until the participant deceases.

In a defined contribution plan you pick how your money will be invested for retirement and you assume the investment risk. See if youre eligible for a Defined Benefit Plan. However rather than providing a guaranteed benefit for life Cash Balance benefits are expressed as account balances.

A cash balance. A passport to your passions. This plan includes the defined contribution retirement account and benefits that are traditionally associated with defined benefit retirement plans such as occupational death and disability.

There is an upper limit to the combined amount you and your employer can contribute to defined 401ks. The calculations are based on a traditional defined benefit plan. It provides you with financial security and options when you retire as well as benefits for your family and loved ones.

However this can be complicated. A 401k and a profit sharing plan can potentially be added to a defined benefit plan. The following individuals are covered under the PERS and earn membership service in the PERS.

If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan. Defined benefit plans are largely funded by employers with retirement payouts. A blended defined benefit and defined contribution retirement plan for the majority of VRS members hired on or after January 1 2014.

In this post we will take a look at. However unlike a Defined Contribution Plan a Defined Benefit Plan provides covered employees with a retirement benefit based on a predefined formula.

Investors Prefer Savings Schemes Pension Plans To Risky Bets Survey Life Insurance Policy Dividend Investing Growing Wealth

Infographic The History And Future Of Small Business Health Insurance Zane Benefits Health Health Insurance Infographic Healthcare Infographics Best Health Insurance

Payslip In The Netherlands How Does It Work Blog Parakar

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

The History Future Of Small Business Health Insurance Health Insurance Infographic Healthcare Infographics Best Health Insurance

Pension Calculator Pension Forecast Retirement Planner

Db Pension Calculator Tpt Retirement Solutions

Defined Benefit Vs Defined Contribution What Is The Best Pension

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

2022 Defined Benefit Plan Contribution Limit How Much Can You Contribute

More 401k Plans Are Offering Advice For A Price Here S Some Free Advice You Can T Beat The Power Of Saving More 401k Plan Financial Tips I Get Money

Kfc Coupons Canada 2022 In 2022 Kfc Kfc Canada Kfc Coupons

Defined Benefit Plan Definition Types Example Explanation

Nn Group Financial Reports

Wbbbb Accounting Management Services The Chart Of Accounts Chart Of Accounts Chart Accounting

Payslip Templates 28 Free Printable Excel Word Formats Words Letter Writing Template Free Printables

Komentar

Posting Komentar